How's Your Portfolio?

Posted: March 11th, 2019

Written by: David J. Volk, Esq. | January 7, 2019

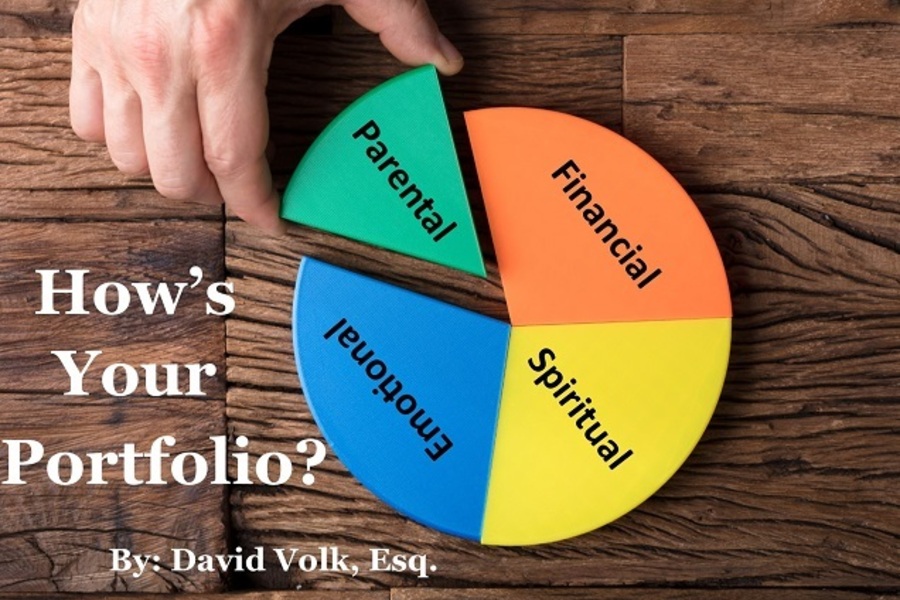

How's Your Portfolio?

No, not your investment portfolio. While that one is important, you have a lot more you are invested in than stocks and bonds. So, how is your BIG portfolio? You know, the one comprised of all the things you are invested in. Is your BIG portfolio balanced?

As many of you know, investment advisors often tell us to do a yearly review of our stocks and bonds portfolio. Even if you are in mutual funds, they may need rebalanced. For instance, Dan Weiner does a good report on the top five Vanguard mutual funds. Yes, even mutual fund investors can get out of balance.

Here are a few explanations on why you need to rebalance investments.

1. The asset mix originally created by an investor inevitably changes as a result of differing returns among various securities and asset classes. As a result, the percentage that you've allocated to different asset classes will change. Rebalance Your Portfolio to Stay on Track, Shauna Carther Heyford Updated Jan 31, 2018. https://www.investopedia.com/investing/rebalance-your-portfolio-stay-on-track/.

2. It’s not quite a Shakespearean dilemma, but lots of investors are wondering: To rebalance, or not to rebalance? The standard advice is that when prices run up in one asset, you should lighten up and use the money to buy lagging assets. That way, your overall allocation stays in line with your plan. If you started 2013 with a mix of 60% stocks and 40% bonds and you’re closer to 65%-35% now, you’d be obliged to sell some stocks and buy bonds. Why You Should Rebalance Your Portfolio, Anne Kates Smith, Kiplinger's Personal Finance, January 2014. https://www.kiplinger.com/article/investing/T052-C000-S002-why-you-should-rebalance-your-portfolio.html.

3. But markets change. They sometimes seesaw rapidly in periods of volatility (usually shorter-term in nature) or perhaps march steadily up or down over longer periods of time. After you've carefully established the allocation that's right for you, shifting market prices will likely alter it in ways you hadn't intended.

For example, when the stock market is doing well and the stocks you own increase in value, stocks will come to represent an ever-larger percentage of your portfolio. This could expose you to more risk than you originally intended.

If your allocation of stocks ends up being greater than you originally planned, and if the stock market were to take a downturn, you might experience a larger drop in portfolio value than you're comfortable with. How and when to rebalance your portfolio, https://www.merrilledge.com/article/how-and-when-rebalance-your-portfolio.

So, what else are you invested in aside from stocks and bonds? January, 2018, I attended a book launch party and two-day seminar for Your Best Year Ever: A 5-Step Plan for Achieving Your Most Important Goals. It was more than eye opening. It helped me significantly improve my life by realizing I needed to improve in some important areas. Author Michael Hyatt teaches a very simple approach to setting goals that you will achieve. In explaining how we can effectively go about goal setting, he calls upon us to do a self-evaluation of all the areas of our life. It sorts out to ten areas. I will give you the link to take the self-assessment at the end.

Hyatt says our life consists of ten primary Life Domains. As you read the list, you will say, of course! But, sometimes we need to realize we have a lot of areas that need managed. It is easy to focus on work or relationships or money. Focusing too strongly on any one or any few areas means some are not being well managed. Without further ado, the BIG ten.

- Intellectual

- Emotional

- Physical

- Spiritual

- Marital

- Parental

- Social

- Financial

- Vocational

- Avocational

How are you doing in those areas? Not sure? Here is the link for the Hyatt self-assessment:

https://michaelhyatt.com/lifescore-assessment

Have fun, don’t be discouraged if you do well in some areas and not so well in others. You’re simply evaluating your BIG portfolio and rebalancing. We humans have a habit of investing too much in one asset class and not realizing we are out of balance. Like keeping a portfolio balanced, having life balance will deliver greater returns.

David Volk, a Business Litigation Attorney with Volk Law Offices, P.A., has over 30 years’ experience and can be reached at help@volklawoffices.com or by visiting VolkLaw online at VolkLawOffices.com

The matters discussed here are general in nature and are not to be relied upon as legal advice. Every specific legal matter requires specific legal attention.

The law is constantly changing and matters discussed today may not be the same tomorrow. Legal matters are also subject to different interpretations by attorneys, judges, jurors and scholars. No attorney-client relationship is intended or created as a result of matters discussed here. You should consult counsel of your choice if you have any dealings in these areas of the law. Volk Law Offices, P.A. and its attorneys make no representations or warranties with respect to the accuracy or completeness of the matters addressed.